Commercial Property Rent or Buy Analysis Calculator

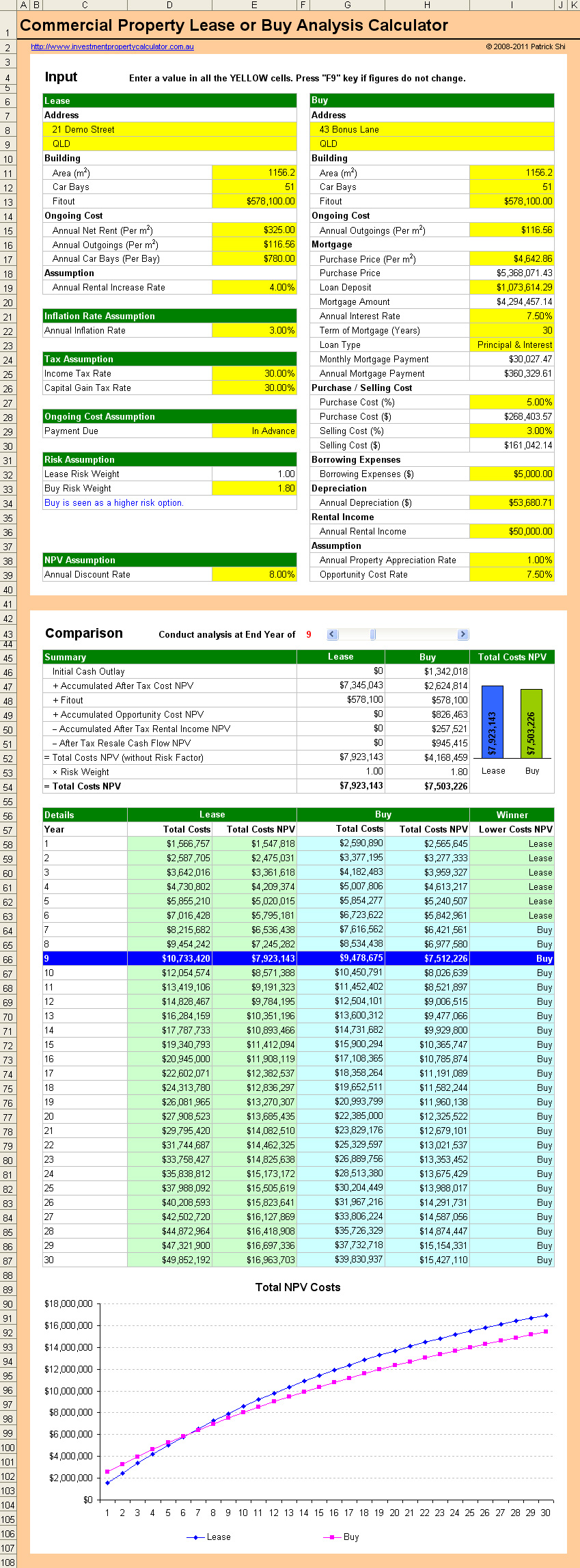

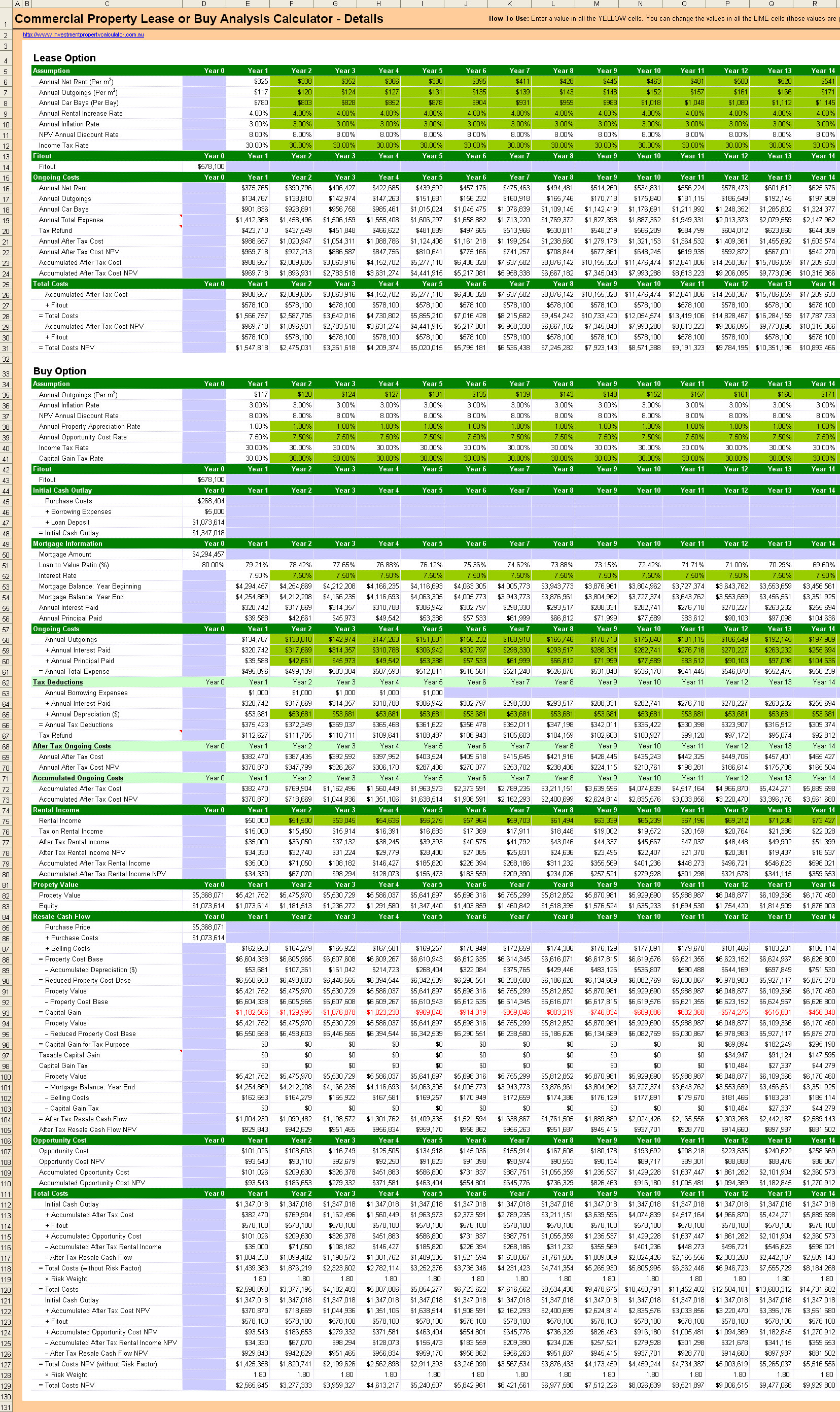

Here are the screen shots that will give you a better idea that what you need to do and how this Commercial Property Lease or Buy Calculator can help you as a business owner.

View full size image of Commercial Property Lease or Buy Calculator

View full size image of Commercial Property Lease or Buy Calculator - 30 Years Details

According to the article "Buy or Lease? Commercial Property Decisions" by Wayne E. Etter and Fred F. Caldwell, buying generally has a higher risk than leasing a commercial property. This is becase "Business enterprises need space to conduct their business activities, but in most cases, real estate is not their principal business. If the firm leases needed space, it can adjust the amount of leased space as market requirements change. If the firm owns real estate, adapting quickly to changes in the market may be more difficult because of the time required to plan and construct a property or to buy a property when more space is needed or to sell the property when less space is needed. A retailer, for example, may prefer to lease space so that store locations can be changed in response to market shifts."

Refund Policy: If you are having issues with a product and need assistance with downloading and/or using the product, please contact us before you ask for a refund as we are confident that we will be able to resolve the issues. If we cannot help you, full refund will be offered within 30 days from the date of purchase. Negative Gearing Calculator will do our best to satisfy all refund requests from customers in a courteous, timely, and fair manner. Again, it will be very much appreciated if you can let us to rectify any issues you are having before asking for a refund.

Buy Now

The Calculator will be sent to you via email.

Cost: $299

File Type

.xlsb - Excel Spreadsheet

Version

1.0.2024

File Size

~230KB

Required

Microsoft Excel® 2007 & above for Microsoft Windows®

OR

Microsoft Excel 2011 & above for Mac

Support

Please use the Contact Form if you have questions.